Because the Virtual assistant money can still enjoys seemingly higher closing costs, many experts as well as their group end inquiring: can we just move this type of will cost you for the complete Va financing to reduce the cash owed at closure?

Simply speaking, not really. Based on a file compiled by the fresh new Institution regarding Experienced Factors Va Local Financing Center, the only real closing charge a fee is move to your a good Virtual assistant mortgage count is the Virtual assistant money fee. Any other closing charges should be reduced in the course of closure by you, the buyer.

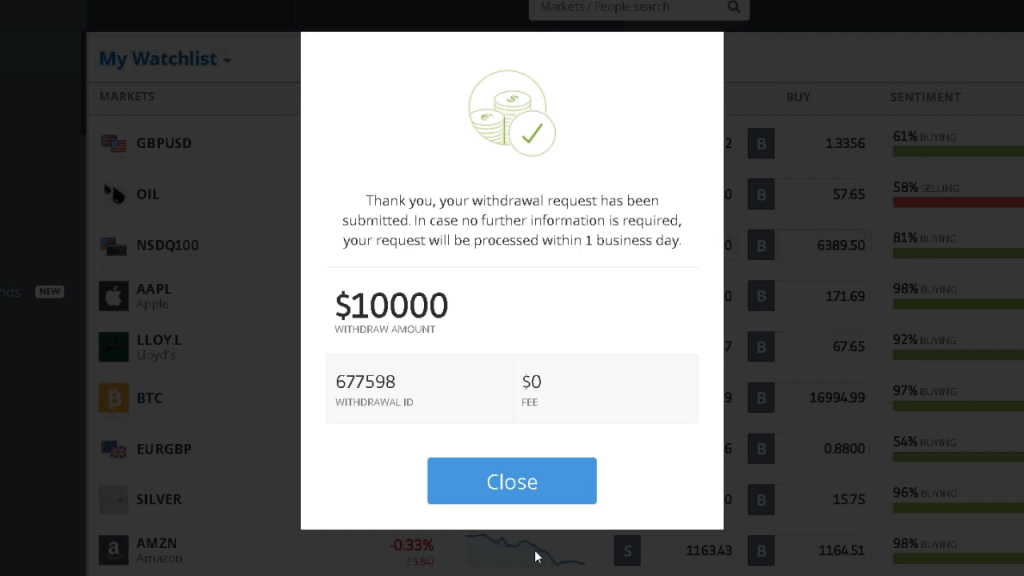

Like, when it is a client’s industry or if you if not features influence, you’re able to discuss towards supplier to cover the the closing costs. Because Virtual assistant caps vendor concessions from the cuatro% of the property loan amount, which could still total probably over $10,000 in the bucks deals.

Perform Va fund want financial insurance?

By contrast, with a conventional loan, consumers exactly who make a down payment below 20% will need to purchase individual financial insurance rates (PMI) and therefore covers the lending company if you standard on your own mortgage. Typically, you’ll pay PMI because the a monthly premium.

Just who should get a beneficial Virtual assistant loan?

Whoever qualifies for a good Virtual assistant financing is about believe it as an option, just like the Va funds have highly competitive cost and you can words having really nothing disadvantage.

To help you be eligible for good Virtual assistant financing, you need to basic see a certificate regarding Qualification (COE) throughout the Va itself. In most cases, most recent services participants that have offered 90 concurrent months to the energetic obligation are eligible, as the is veterans just who offered at the very least 3 months throughout the wartime otherwise 181 months throughout the peacetime. Disabled veterans, enduring spouses, and you will National Guard and you will Reserve people may also meet the requirements-comprehend the over directory of COE qualifications standards right here.

Next, you must qualify since the a debtor. Va funds do not have the absolute minimum credit rating criteria however, loan providers perform, as well as them, normally, this is around 620 (although some eg Skyrocket Financial allow it to be credit scores as low as 580 having Va funds). You’ll my review here also you desire a debt-to-money (DTI) proportion from 41% otherwise straight down.

Fundamentally, you need to be prepared to move around in. This new Virtual assistant merely enables you to pull out an excellent Va loan to suit your top home-maybe not the next, vacation or local rental possessions. You also have to move into the in this a good sensible big date, plus antique armed forces manner, this new Virtual assistant provides an accurate concept of reasonable while the within this two months, if you do not can certify a later date contained in this 12 months

So in order to recap, you should at the least believe a good Va financing for people who satisfy most of the called for official certification: a good COE, 620+ credit rating, 41% or all the way down DTI and you are clearly prepared to move.

Pros and cons of Virtual assistant loans

While you are Virtual assistant financing are perhaps one of the most attractive home loans on the market, they still have slight cons and you will caveats to adopt.

I have bought a house having fun with good Virtual assistant mortgage and you may observed so much regarding someone else go through the process, Alex, an active-duty U.S. Air Force chief, advised Fortune Recommends. The genuine financing processes was pretty straightforward-comparable to a normal financing-and decreased advance payment is definitely amicable so you’re able to more youthful provider users having which 20% might possibly be a great year’s paycheck or maybe more. Including, the greater amount of rigid inspection standards provided me with support because the a (then) first-time homebuyer.

Is actually Va funds universally greatest? We frequently state it depends,’ the guy told me. It have their cons-0% off mode you’ll have minimal security for quite some time, and Va assessment requirements mean you simply can’t buy an effective fixer upper having an effective Va financing. If you don’t, it unlock gates to help you young army parents who might not if not meet the requirements.