Cash-Aside Refinancing

A money-away refinance allows you to re-finance your residence if you’re pulling-out the brand new guarantee for the cash. When you pertain, the lender commonly calculate the latest collateral you have of your property because of the deducting your own house’s well worth about number you borrowed. It shape will be multiplied because of the 80 or 85 percent (or maybe more when your lender it permits) to choose your loan count.

During the closing, you will get the borrowed funds count when you look at the bucks. And if costs restart, you only pay for the brand new financing (that includes the original loan balance therefore the count your dollars out) to have fifteen or three decades, with respect to the name.

Unsecured loans

You can also fund your home developments that have an unsecured individual loan. Security actually expected, so your family will not be in danger of foreclosures for those who slide toward crisis. But you will you would like stellar borrowing to qualify for a knowledgeable rates, along with your costs could well be towards top end since most incorporate financing terms of four otherwise eight years.

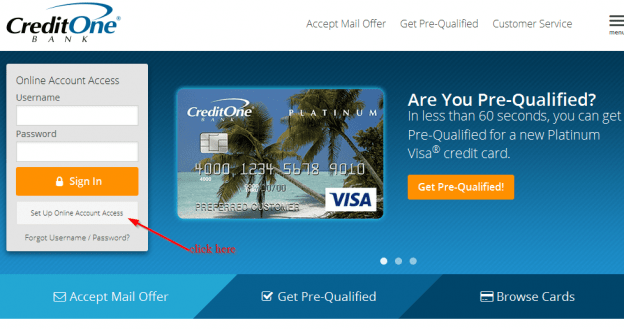

Credit cards

Credit cards is a pricey treatment for purchase renovations if you do not score an excellent 0% desire bank card. The secret is always to spend the money for harmony out of in the advertisements Apr period, or you might spend several thousand dollars when you look at the focus over the years paying down the balance.

Do-it-yourself Online calculator

After you have set a spending plan and you may looked funding options, explore property improvement online calculator to locate a sense of your own prospective borrowing energy and you can mortgage conditions.

Extent you might obtain depends on multiple facts, just like your loan kind of, most recent family worthy of, a fantastic mortgage harmony, area, and you can credit score. Fool around with an online calculator to the bank you’re considering, similar to this that, discover a real guess.

Estimate Your Monthly Home improvement Mortgage Money

You could potentially imagine their monthly obligations of the inputting the loan amount, interest, and you may payment name on an internet calculator like the you to located here.

Where you’ll get a house Improvement Mortgage

It all depends into the kind of mortgage you prefer, your borrowing wellness, as well as your home’s equity. An unsecured unsecured loan is generally best if you need https://paydayloanalabama.com/rehobeth/ to make advancements in the near future and possess a or expert borrowing from the bank. But beware one to costs could be high, depending on how much you acquire therefore the mortgage identity. You are able to play with an effective 0% Apr credit card to cover your project when you can shell out it well till the marketing and advertising focus period always between a dozen and you can couple of years ends.

Want to leverage your house equity to help you safer money? A property security financing, HELOC, or cash-away re-finance is a far greater fit. The program process and time for you to money much more slow, nevertheless was eligible for a tax deduction towards one interest paid back. Also, you could potentially rating a diminished interest than you would score having an enthusiastic unsecured personal loan or bank card. And you will probably have probably a very extended period to repay what you owe.

If you like to own alot more alternatives and improved borrowing from the bank stamina, consider using RenoFi to find the prime do-it-yourself mortgage solution. The platform focuses primarily on providing link property owners having borrowing unions that offer versatile loan selection which have competitive prices. In addition to this, you could acquire around 90 per cent of your own home’s immediately following-recovery worth. You will become tasked a dedicated RenoFi coach simply to walk your through the software process at all times.

If you need a more impressive amount to funds the repair, thought an effective HELOC from RenoFi. You will be qualified to receive a loan as high as ninety % of one’s residence’s estimated just after-recovery well worth from of the credit unions inside their system of lenders.