If you are to order a home, the newest documents process are going to be perplexing, intimidating, and you may apparently instead of prevent. For many individuals, running home is still this new American dream, but it’s even more challenging and hard to get recognition toward a mortgage out of a lender. It guides of several possible people to spend a king’s ransom, day, and you can cardio toward acquiring the house they need, merely to have the resource break apart in the last second.

Personal loan providers, such as for example Financial Rules Financial, promote particular pros across the old-fashioned lender home loan framework. Knowing the huge difference is very important if you are searching to buy property.

What is actually a private Mortgage Financial?

Bringing a home loan compliment of a financial will be a great solution for those who have unaltered credit, easy access to intricate monetary info, and several determination. Prices are generally lower when you get a home loan due to an excellent bank vs. an exclusive bank, although not, many people usually do not manage to get thier financing accepted through the old-fashioned lender financial channel. He’s most rigorous certificates and guidelines that need to be came across once the money is actually federally insured. If you have a less than perfect credit get otherwise one imperfections in your credit history, you may find your loan software refused – after a very long, demanding wait.

Individual loan providers, at exactly the same time, efforts using finance furnished by individual traders. These types of individual buyers can include banks, someone, otherwise each other. Private loan providers specifically render individual funds. Since these financing can carry an advanced away from exposure, the interest pricing are also a tiny higher than what you would rating with a home loan of a traditional bank. The fresh new buyers which funds the private lending institution make their currency regarding interest rates won toward personal finance it increase. Because these cost are typically higher, they’re able to have a tendency to secure significantly more than mediocre prices regarding Riverside savings and installment loan return on their investment.

Why Prefer a private Financial In the place of a bank?

For starters, a personal home mortgage bank for example Economic Rules Financial now offers higher flexibility than just extremely conventional banking companies. If you’re individual loan providers still need to conform to certain exact same usury regulations one to a classic bank does, personal financing organizations are smaller strictly regulated than just financial institutions. This enables them to structure various sorts of fund that usually match the client’s appropriate financial situation on their owning a home desires.

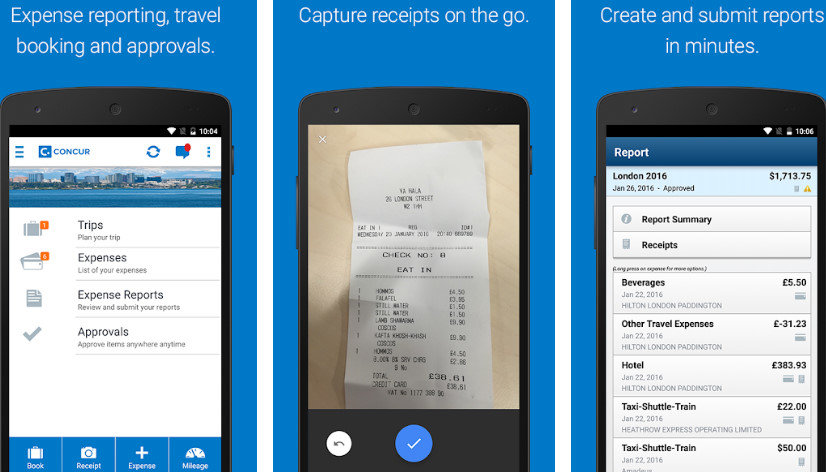

Acquiring a mortgage loan due to a private lender is typically a good much faster and much easier process than simply getting one away from a financial. Financial institutions need comply with several possible agencies including Fannie mae, Freddie Mac, You.S. Institution regarding Property and you may Urban Advancement (HUD), and/or Pros Administration (VA), that have very strict laws to the that is a reasonable candidate for a loan. You will find slopes of documents, those variations so you can indication, and lots of data files in order to gather and you can fill out, either more than weeks, included in the regular lender home loan app procedure. When you get home financing from a financial, it strike in many studies and a pc determines even though youre a reasonable credit risk. There clearly was little to no discretion to move out-of those criteria and requirements.

Private lenders grab a customizable and you may tailored method to lending. Like, an exclusive bank could possibly neglect defects from your past that appear on your credit history and thought affairs far alot more most recent, just like your obligations-to-money ratio. They evaluate the financing you are searching for bringing and you will think if it is reasonable to suit your money. Should your risk seems somewhat higher, capable usually nonetheless offer you that loan you to a classic financial won’t, from the a slightly highest interest to really make the individual lender’s dealers feel more comfortable with the school delivering you to chance.

Why does Personal Lending Work?

Much like which have a timeless financial home mortgage, the initial step is actually obtaining prequalification. We offer a useful checklist off documents you will need to get already been with your app. The preapproval will assist you to understand how to structure your research around your being qualified budget.

If you’ve currently known a house you want to purchase and you may are prepared to generate an offer, contact your individual financial to enable them to render an evidence of finance letters for you. We all know anything can disperse quickly for the bidding techniques, therefore we try and score what you want the same date you put in a request, also in just several hours, when possible. If you’ve currently got a bid acknowledged, we work with you so you’re able to easily have the appraisal and you will review done this you can preserve the procedure swinging easily. The interest rate foundation are an enormous benefit to those who buy home to own economic purchases, such as those whom purchase likely to fix up the home and rapidly lso are-sell or flip they.

Really, whatever the aim of their financial software, the procedure performs very much like it can that have financing regarding a financial, except it is quicker and simpler.